Part II: Financing your solar installation

Pakistan

500+ MW Solar PV

90 MWh REFLEX

5,500 Telco Towers

In continuation with the “buying vs leasing” debate, the second financing option is a ‘solar lease model.’ On paper, for many organizations solar leasing sounds quite lucrative as it allows them the opportunity to upgrade to a solar system without a prior investment.

Hence, some key factors to consider when deciding on ‘solar leasing’ as a financial option are as below:

Solar Leasing

Solar Leasing, is a good short-term solution for many organizations as it comes with not only a zero-upfront cost but also an immediate savings on the monthly utility bill. Furthermore, in the long run, organizations can also experience an increase in savings when traditional energy costs might rise.

Other advantages include:

- Paying only for the electricity consumed.

- No responsibility for operations or maintenance.

- Lower energy rates than standard grid rates

- Hedging against future jumps in electricity rates

However, a few solar leasing shortcomings that need to be considered are that since a third party pays for the installation, they have complete ownership of the system (at least for 20 years). More so, even though the monthly utility bill decreases, it isn’t as much of a decrease as the leasing company does recoup the cost of its investments from the overall solar energy savings. Lastly, as lucrative as solar leasing maybe, it isn’t an option open for all. Most, solar providers have set criteria on filtering out which organizations fit the bill, and which do not.

Solar Leasing

Business Case

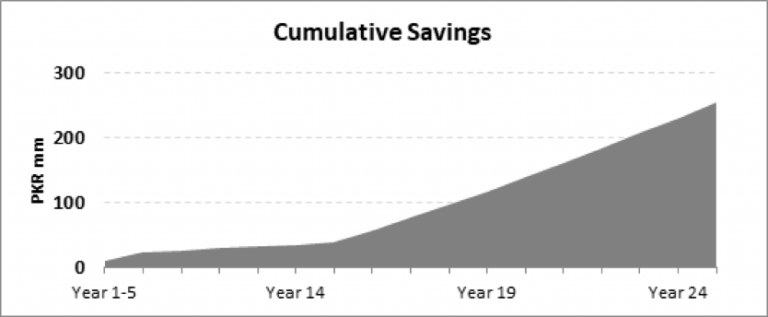

Additionally, the graphic representation of a textile business case model below will help in demonstrating an organization’s cumulative savings. More so, it will help in concluding the second part of the ‘buying vs leasing’ debate.

An organization opting to go for solar leasing on a 1000 KW solar power project that is an on-grid system (with all other factors such as, rooftop etc. constant) can certainly reap savings as high as approximately 250 million. However, these savings are nowhere close to what an organization could reap had they gone for a cash purchase model. Part I: Financing your solar installationThis is because the organization will still be buying the electricity from the leasing company which will be recouping the cost of its investments from the overall solar energy savings.

Hence, regardless of the “buying vs leasing” debate, the end goal is to go solar. Every organization’s needs, situations and end decision making may vary but these are a few pointers that should be kept in mind. Moreover, considering the right Solar Solutions Provider can really help in narrowing down the right financial options that fit your organization.