Going solar not only saves up a substantial chunk of your energy bills but is also the biggest step any organization can take at being more environmentally conscious. However, with the decision comes the daunting task of deciding on a solar financing option.

Fortunately, going solar is affordable by making an informed decision about the best funding options; be it buying or leasing. Some key factors to consider when deciding on ‘cash purchase’ as a financial option are as below;

Cash Purchase

Buying a solar panel system seems like a big up-front cost but it really is a long-term investment. An organization that decides to pay a little more up-front can reap benefits for decades to come. More so, a 30 percent reduction in electricity bills reflects the expected amount of savings. Other advantages include:

• A reduction in the total time required for installation

• Generally, a maximum return on investment is offered

• Complete ownership of the asset

However, with complete ownership of the asset also comes an organization’s sole responsibility of both its operation and maintenance. Therefore, if/when considering the cash purchase route capital costs and product warranties should be taken under careful consideration.

Business Case

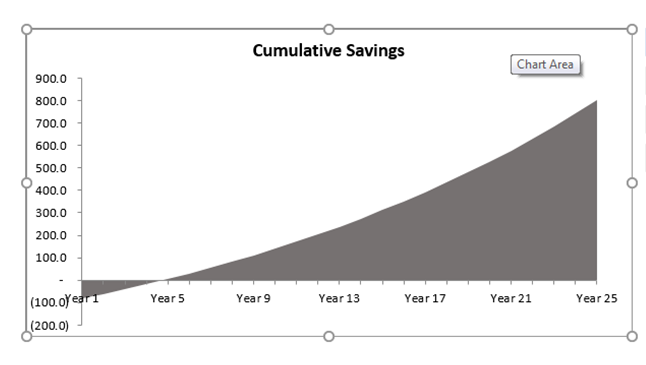

Lastly, the graphic representation of a textile business case model below will help in demonstrating an organization’s cumulative savings. More so, it will help in concluding one part of the ‘buying vs leasing’ debate.

An organization opting to go for a cash purchase on a 1000 KW solar power project that is an on-grid system (with all other factors such as, rooftop etc. constant) can reap savings as high as 800 million. The savings in case of a cash purchase model sees a steep, steady growth as the organization is producing its own electricity. There by reducing their cost and increasing their overall savings.